Please click here to view the Oasis investor presentation on Hokuetsu.

Why Is Accountability Needed NOW at Hokuetsu?

During Mr. Kishimoto’s 15 years as CEO, Hokuetsu has:

· Failed in corporate governance

· Failed to plan for the future, despite increasing challenges to the paper industry

· Failed to increase employees’ salaries by growing the business

· Failed to meet the mid-term plan targets for four consecutive mid-term plans over the past 12 years

· Failed to either divest its cross-shareholding with Daio or realize synergies

· Failed to manage the risks of holding such a large cross-shareholding

· Failed to meet with Oasis, its largest shareholder owning 18%, despite repeated requests over years

Despite these failures, Mr. Kishimoto remains in leadership and retains total control over decision-making at Hokuetsu. It is time for shareholders to hold him and the Company accountable. Therefore, Oasis calls for

ACCOUNTABILITY NOW

**

For more details of some of Hokuetsu’s governance failures under Mr. Kishimoto’s leadership, please see:

Failure 1: Mis-Management

Japan’s Paper Industry Is In Severe Decline

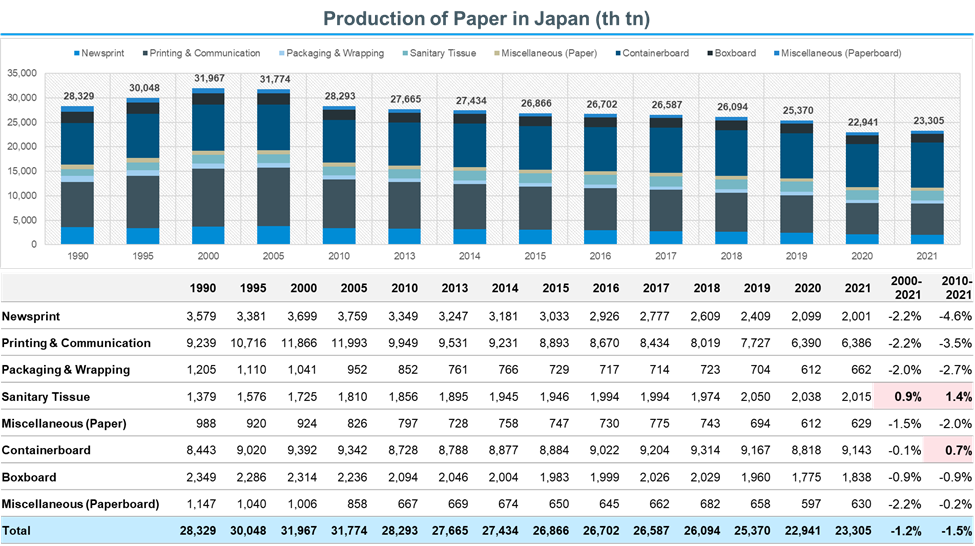

The paper industry has been shrinking at -1.5% per year (CAGR) since 2010, as the digital age, accelerated by the Covid-19 pandemic, takes off

Sanitary paper and containerboard are the only paper products which have grown

Hokuetsu’s Business is Heavily Weighted to Paper Pulp Prices

Mr. Kishimoto led the Company’s focus on the declining paper business, missing substantial opportunities in the renewable energy business

Hokuetsu’s Management Have Had an Inconsistent Strategy

Employees are Paying the Cost

Employee Salaries Have Decreased Over Mr. Kishimoto’s Tenure

During Mr. Kishimoto’s tenure as CEO, the salary of Hokuetsu employees decreased by -9%

Failure 2: Poor Governance

Mr. Kishimoto Has Held His Role for 15 Years

CEO Mr. Kishimoto (76) has served as a Hokuetsu board member for ~24 years and CEO for ~15 years

The Company deserves a new CEO to execute a bold plan to secure Hokuetsu’s future

During his tenure leading Hokuetsu, Mr. Kishimoto has failed to deliver on almost ALL of his promises over the past decade

Mr. Kishimoto Failed Again this Year to Achieve the Mid-Term Plan

Hokuetsu’s results fell significantly short of the targets set in its current mid-term plan

These results are unacceptable

Hokuetsu’s reappointment of Mr. Kishimoto as CEO demonstrates clear governance failures, considering the Company’s current and past results

During Mr. Kishimoto’s Tenure, An Employee Embezzled Funds in 2015

In 2015, an employee of Hokuetsu embezzled funds

The Company lost JPY2.5bn on the incident

Mr. Kishimoto Fired All Younger Directors in What Appears to be an Effort to Preserve His Leadership

Since Mr. Kishimoto became CEO in 2008, he has fired all the other senior directors, in order to preserve his role and maintain his rule over the company

In the upcoming AGM, the Company announced that Mr. Yamamoto, Mr. Kondo and Mr. Otsuka will leave the company

The Board Needs to be Refreshed for Future Growth

The average age of directors on Hokuetsu’s board is 67 and only one female director sits on the board

Mr. Kishimoto’s leadership must end so the company can make decisions for future growth

We believe Mr. Tachibana has sufficient experience in the industry to run the Company

Oasis’ requests for a meeting with Mr. Kishimoto have been repeatedly declined, despite being the largest shareholder and depsite the Corporate Governance Code encouraging dialogue

Failure 3: The Daio Cross-Shareholding

Hokuetsu’s Refusal to Sell its Daio Cross-Shareholdings Led to a

JPY40Bn Loss

in Economic Value to Hokuetsu & Its Stakeholders

Hokuetsu’s Valuation is Far Below Book throughout Mr. Kishimoto’s Tenure due to Its Massive Cross-Shareholdings

Japan’s Corporate Governance Code Encourages the Sale of Cross-Shareholdings

The Corporate Governance Code encourages the sale of cross-shareholdings

ISS & Glass Lewis Recommend Voting AGAINST CEOs with Significant Cross-Shareholdings

Hokuetsu’s Return From Its JPY ~33Bn Daio Investment is Only JPY ~5Bn In 17 Years

Hokuetsu has made JPY ~5bn in return, while its total investment in Daio shares is JPY ~33bn

This means Hokuetsu has made a 15% return over 17 years, or an 0.90% return on an annual basis

There is no objective reason for Hokuetsu to use such a substantial amount of its balance sheet on an investment that only returned 0.90% per year over 17 years

Investing in Topix Would Have Been a Better Investment For Hokuetsu

Daio share value and dividends received from Daio amount to ~43 Bn JPY against a ~33 Bn JPY investment. This means the absolute return from investment in Daio is 29%

An investment in TOPIX over the same period would have returned ~56 Bn JPY, yielding a 72% return

Daio’s Earnings Have Severely Declined Due to the Energy Price Hike

Daio shares have plunged due to the recent hike in prices of raw materials and fuels

Despite this, Hokuetsu has taken no action, even though it is in the same industry and should have anticipated the severe earnings decline

Hokuetsu Explicitly Mentions the Purpose of Holding Daio Paper Shares as “Cross-Shareholdings” in Its Significant Holder Disclosure