Oasis has been engaging with Hokuetsu since 2019 to encourage the Company to improve corporate governance, increase its corporate value, and improve profitability.

In October 2021, Oasis announced a public engagement campaign (“A Better Hokuetsu”) (https://abetterhokuetsu.com ), encouraging Hokuetsu to sell its stake in Daio. Since then, Daio’s share price has declined by -48%, resulting in a loss of economic value to Hokuetsu and its shareholders of JPY40 billion, equivalent to five years of Hokuetsu’s net profit.

In May 2023, Oasis announced a second public engagement campaign (“Accountability NOW”) encouraging fellow shareholders to vote AGAINST Kishimoto’s re-election as a Board of Director, to hold him accountable for his track record of mis-management of Hokuetsu.

Today, Oasis is the second-largest shareholder of Hokuetsu, owning over 18% of the Company’s shares outstanding.

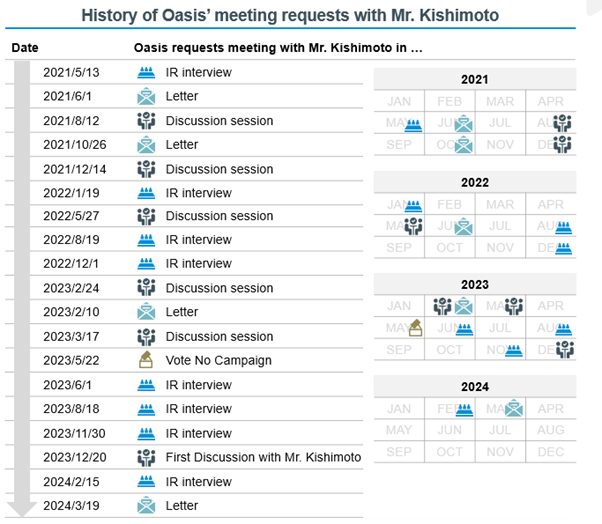

Despite Oasis’s repeated requests, and notwithstanding our status as the Company’s largest shareholder for years, and current status as the Company’s second-largest shareholder, we have been granted an audience with Mr. Kishimoto just once, in December 2023, after five years of engagement.

The time has come to end Mr. Kishimoto’s control and make way for better corporate governance and clear, objective decision-making.

Daio Kaiun has submitted its shareholder proposal to appoint five director candidates as truly independent external directors. The recent investor presentation of the five director candidates nominated by Daio Kaiun demonstrated their managerial experience and qualification to serve as independent directors and provide their advice in the respective fields of their experience and expertise. Our candidates were impressed by the profiles of the five candidates. Our candidates believe that the expertise and skill set of the five director candidates nominated by Daio Kaiun are complementary to those of five director candidates nominated by Oasis.

Oasis agrees with their observation. Oasis believes that the combined team of the 10 independent directors would form a diverse and well-qualified board and work well together to enhance governance and increase corporate value of Hokuetsu and the collective wisdom of these external directors will be great valuable assets to Hokuetsu.